Crypto Company Formation in the EU: Which Jurisdiction is Right for You?

We are all about helping you inform better business decisions, this is why we have Compared 13 Jurisdictions in the EU for setting up a crypto company.

Cryptocurrency is a rapidly growing industry with a global impact, and Europe has emerged as a major player in this field. With a number of countries offering favorable regulatory environments, access to skilled talent, and lower tax rates, it can be challenging for business owners to determine where to incorporate their European-based cryptocurrency company.

In this article, we have provided an objective comparison of 13 European countries, highlighting the pros and cons of crypto incorporation.

For each location, we have covered information based on factors such as regulatory environment, corporate tax rates, access to talent, and availability of funding. We have also listed the current regulating bodies in charge of issuing crypto licenses for each of them.

This article’s aim is to provide a starting point for the decision-making process, by highlighting the key factors that are likely to impact cryptocurrency businesses in each location.

We recommend that you conduct your own research, consult with legal and financial experts, and take your specific goals and needs into account in order to make an informed decision about where to incorporate your European-based cryptocurrency company.

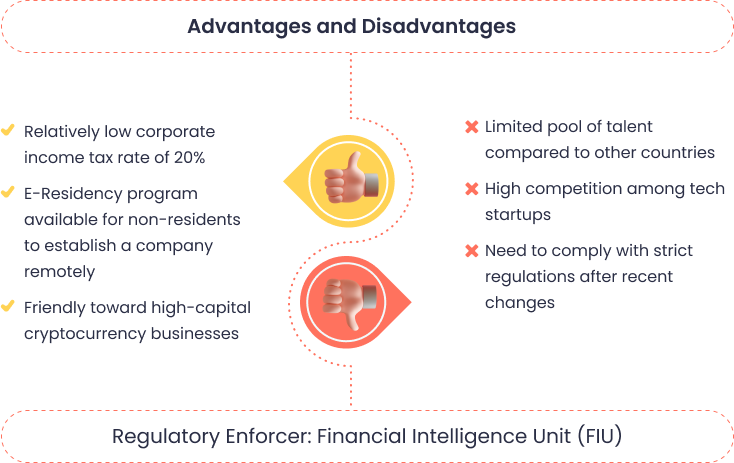

🇪🇪 Estonia

While Estonia was previously known for its easy-going regulatory environment and friendly attitude towards the cryptocurrency industry, recent changes in regulations have made it a more challenging environment for startups. While Estonia still offers a streamlined business incorporation process and a skilled workforce, the regulatory environment for cryptocurrency businesses has become more stringent.

As a result, startups in the crypto industry may face greater compliance requirements and a more complex regulatory landscape in Estonia.

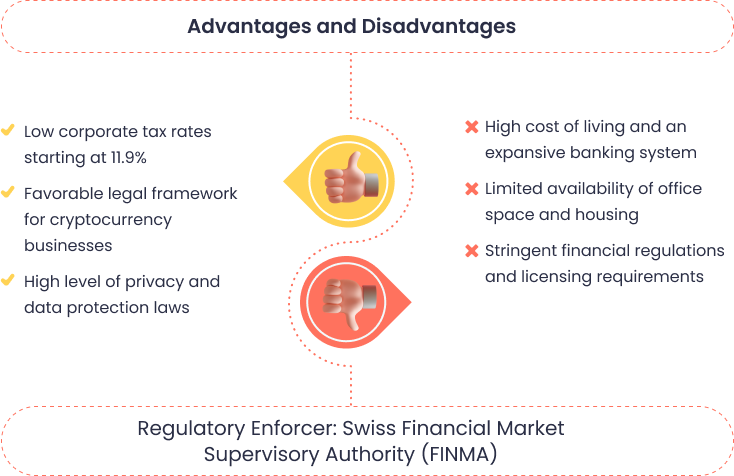

🇨🇭 Switzerland

Switzerland has been a hub for financial innovation and technology for many years and has emerged as a leading location for cryptocurrency startups. The country’s strong reputation for financial stability, skilled workforce, and access to funding sources make it an attractive location for entrepreneurs in the crypto industry. The city of Zug has emerged as a hotspot for cryptocurrency startups, with a number of successful companies based in the area.

While Switzerland is no longer part of the EU following Brexit, it remains a promising location for cryptocurrency businesses looking to access the European market.

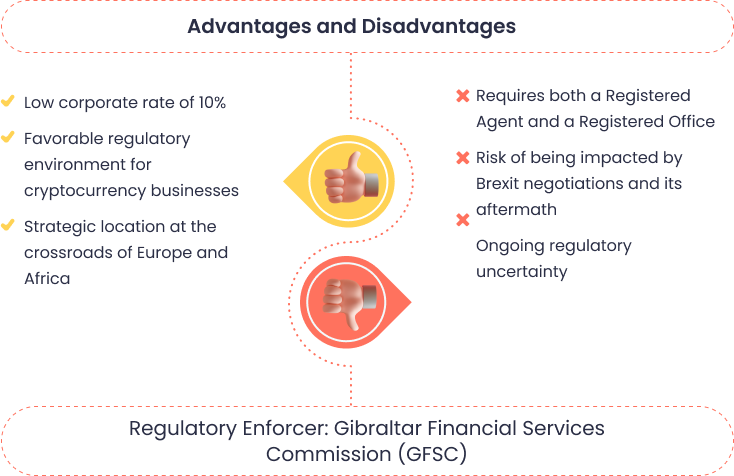

🇬🇮 Gibraltar

Gibraltar is a small British Overseas Territory located on the southern coast of Spain and has emerged as a popular location for cryptocurrency businesses. The jurisdiction offers a favorable regulatory environment for cryptocurrencies, including a DLT (distributed ledger technology) regulatory framework, which provides clarity and certainty for businesses operating in the industry.

Gibraltar also offers a competitive corporate tax rate and access to funding sources.

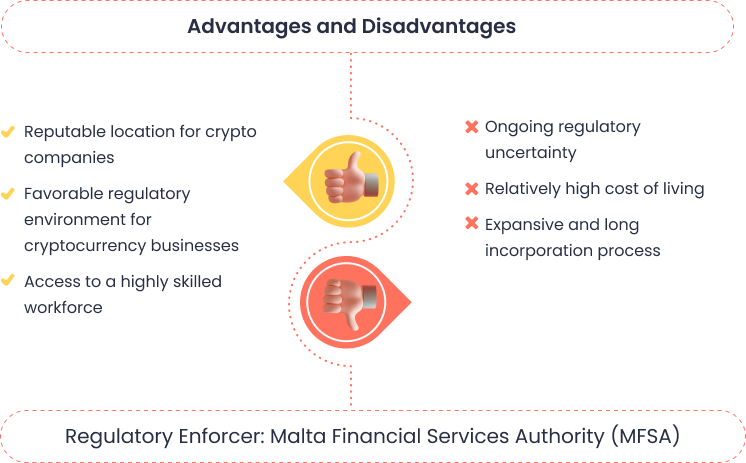

🇲🇹 Malta

Malta was once regarded as a welcoming and crypto-friendly jurisdiction for cryptocurrency businesses, recent changes to the regulatory environment have made it a more challenging location. The country still offers a favorable tax rate and access to funding sources and has a skilled and multilingual workforce. However, the regulatory framework for cryptocurrency businesses has become more stringent, which may result in increased compliance costs and a more complex regulatory landscape for startups. Business owners should conduct their own research and consult with legal and financial experts to ensure they comply with all applicable regulations if considering Malta as a potential location for their cryptocurrency business.

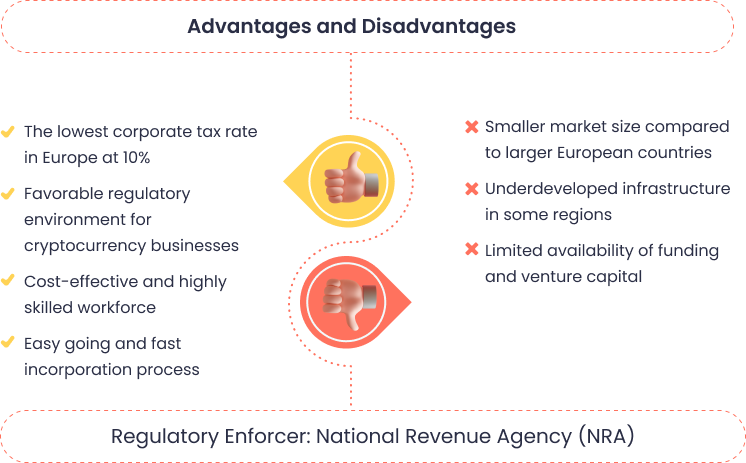

🇧🇬 Bulgaria

Bulgaria has established itself as an attractive location for cryptocurrency businesses due to its low corporate tax rate, favorable regulatory environment, and cost-effective workforce. The country has a fast and easy incorporation process, making it an appealing option for entrepreneurs in the crypto industry.

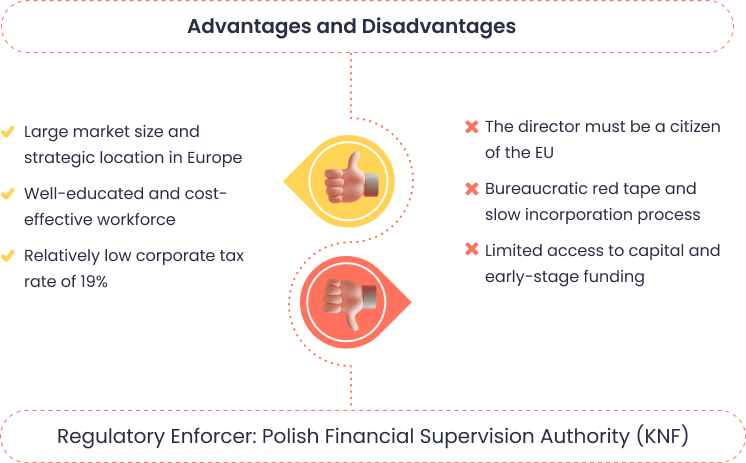

🇵🇱 Poland

Poland has a relatively high corporate tax rate compared to some other jurisdictions, but its large domestic market and favorable regulatory environment for technology companies make it an attractive location for cryptocurrency entrepreneurs. The country is home to a growing tech sector and has a skilled and cost-effective workforce, making it an appealing option for startups in the crypto industry.

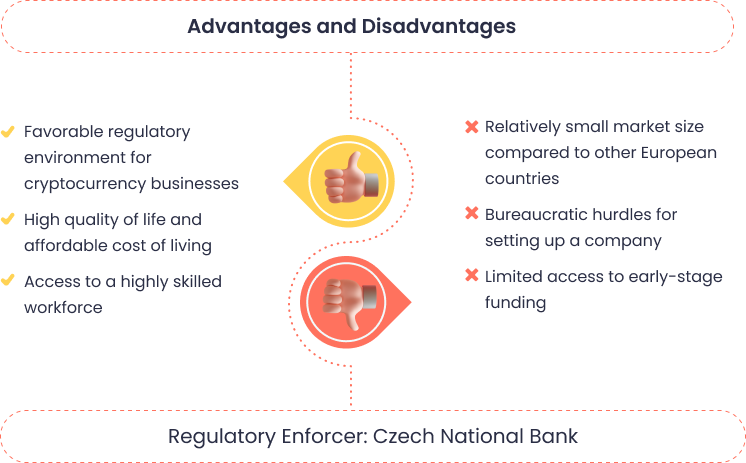

🇨🇿 Czech Republic

The Czech Republic has a growing tech sector and skilled workforce, making it an appealing location for cryptocurrency businesses. the country’s strategic location in Central Europe and strong trade links are significant advantages.

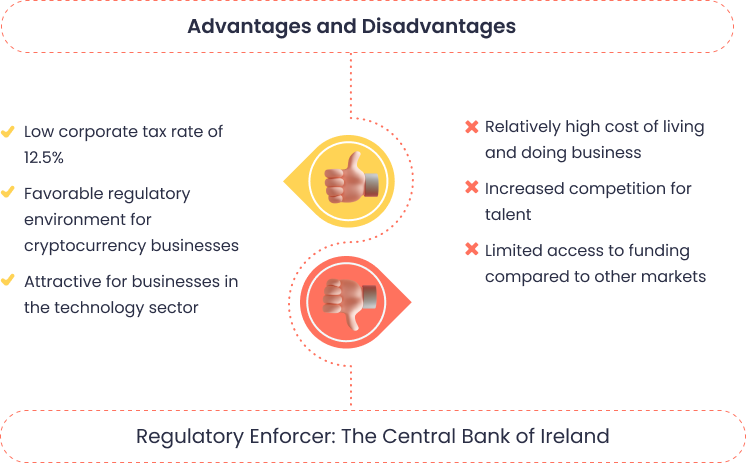

🇮🇪 Ireland

With its highly educated and multilingual workforce, Ireland is an increasingly popular location for cryptocurrency businesses. The country’s robust tech ecosystem, favorable business environment, and the competitive corporate tax rate of 12.5% make it an attractive location for startups in the crypto industry.

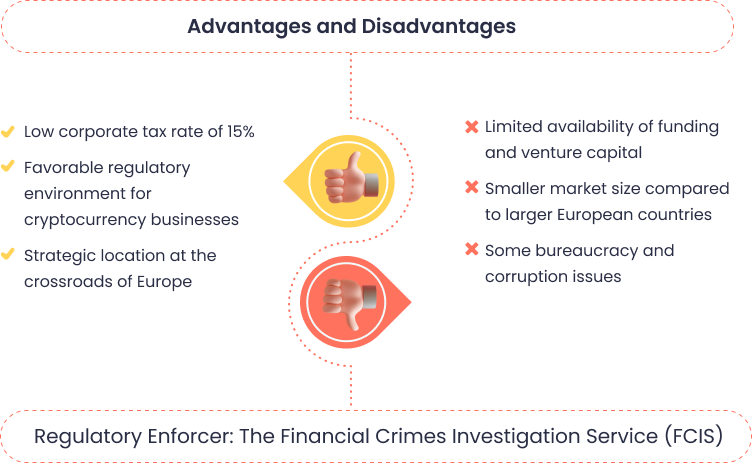

🇱🇹 Lithuania

While Lithuania was previously known for its favorable regulatory environment for cryptocurrency businesses, recent changes have made it a more challenging jurisdiction. The country has tightened its regulations on cryptocurrencies, making it a less attractive location for startups in the crypto industry. While Lithuania still offers a low corporate tax rate of 15% and access to funding sources, the regulatory environment for cryptocurrency businesses has become more complex. Startups in the crypto industry may now face greater compliance requirements and higher regulatory costs.

In conclusion, the decision of where to incorporate a cryptocurrency company is a complex one, it may be beneficial for you to consult with one of our expert advisors who can provide more tailored advice and guidance based on your specific needs and priorities.

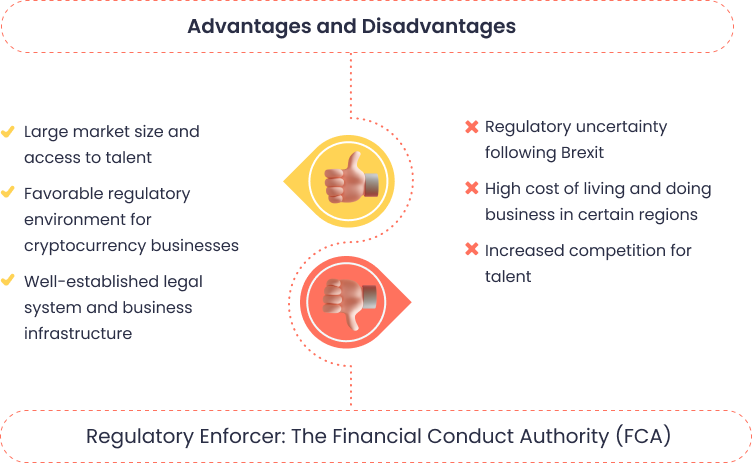

🇬🇧 United Kingdom

As one of the world’s largest economies and a leader in financial services and technology, the United Kingdom is a good location for cryptocurrency startups. The country has a skilled and diverse workforce, access to abundant funding sources, and a favorable regulatory environment for cryptocurrencies. The corporate tax rate in the UK is currently 19%, which is in line with some other European jurisdictions. However, Brexit has created some uncertainty around the future relationship between the UK and the EU, which may be a factor for some businesses.

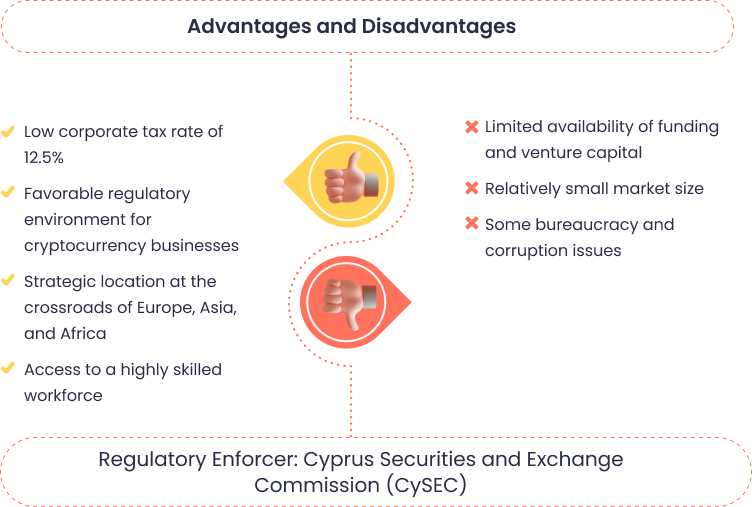

🇨🇾 Cyprus

With its strategic location at the crossroads of Europe, Africa, and Asia, Cyprus is an attractive location for cryptocurrency startups looking to access multiple markets. The country offers a low corporate tax rate of 12.5%, making it a favorable location for startups in the crypto industry. the country’s regulatory environment for cryptocurrencies is still developing, and there may be limitations or barriers for businesses operating in the industry.

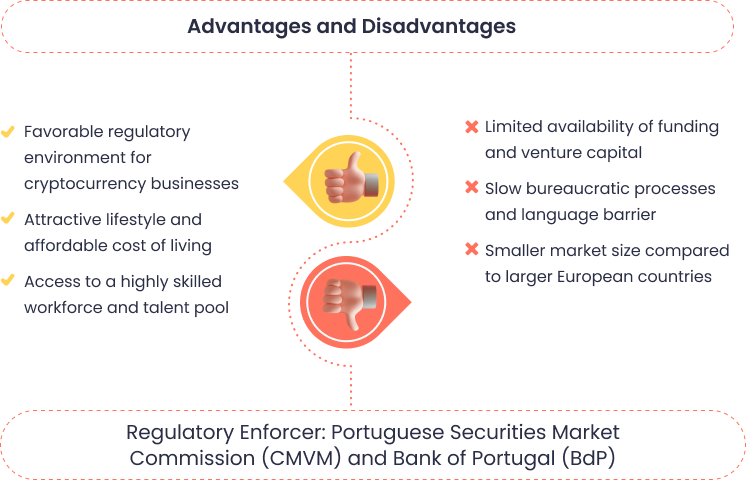

🇵🇹 Portugal

With its growing startup scene and favorable business environment, Portugal is an increasingly popular location for cryptocurrency businesses. The country offers a corporate tax rate of 21%, which is still competitive compared to other European jurisdictions but is on the high end compared to our list.

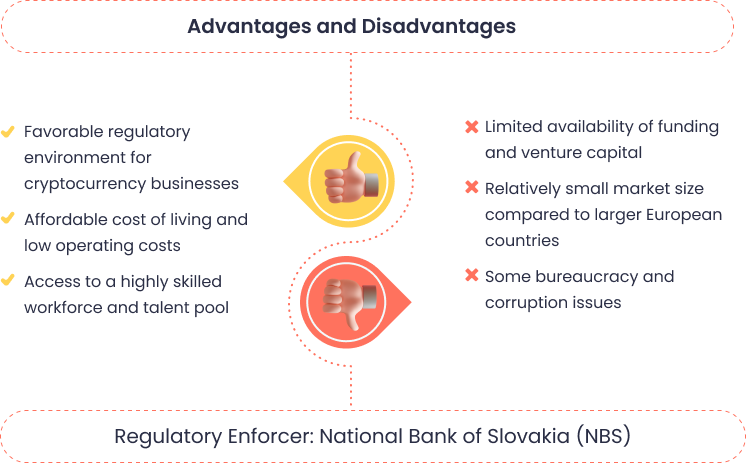

🇸🇰 Slovakia

The country’s economy has been growing rapidly in recent years, driven by the automotive and IT sectors, and the government has made significant investments in infrastructure and education to support innovation and entrepreneurship. Slovakia offers a favorable business environment for technology companies and access to government funding for startups.