Payroll in Bulgaria

Calculation procedure

All employment relationships in Bulgaria are regulated by the Labor Code, as well as other laws on legal requirements in the field of employment, such as the Law on Labor and Safe Working Conditions, the Law on Employment Promotion, etc.

Payroll in Bulgaria consists of:

- Monthly calculation of working and sick days for all employees;

- Amounts of gross salaries, bonuses and other benefits;

- Information on the fulfillment of the necessary deductions;

- Payroll, social security orders, and wage orders to the employer;

- Two additional declarations sent to the National Revenue Agency.

In some cases (illness) and after filing a declaration, the sick leave must be drawn up no later than the 10th day of the next month

Salary

In accordance with Bulgarian law, at the time of 2019, the minimum wage was 286 euros per month. This rate applies to everyone, regardless of age, industry and experience. Also, depending on the position and industry, minimum thresholds for social security are provided, therefore, if the salary is minimum, social security contributions are calculated at the minimum threshold.

Insurance contributions

National insurance contributions are contributions to social and health insurance. This is a system that guarantees protection in case of accidents at work and their consequences, and serious risks.

The Social Insurance Code (SSC) contains all the provisions of social insurance.

The Bulgarian insurance system covers such risks as:

- General disease;

- Work related accidents;

- Occupational disease;

- Maternity;

- Unemployment;

- Old age;

- Death;

Working hours

According to generally accepted standards, working hours in Bulgaria should not exceed 40 hours per week with a 5-day work schedule.

Other options are possible:

- 48-hour work week with a limit of 60 work weeks, 20 of which (maximum) can be consecutive;

- Shortened working hours of 6-7 hours for minors or for people working in life-threatening conditions;

- Unspecified working hours for certain positions;

- shift shifts;

- Overtime work (although it is prohibited);

- Part-time work, but not less than 4 hours a day;

- A flexible work schedule, in which an employee comes to work at a fixed time and spends time there until 13:00, for example, and then is free to manage his work schedule as he likes, subject to the agreement of such activities with his superiors.

The employee and the employer, by mutual agreement, may decide to abandon the standard arrangements.

The work schedule of minors should not exceed 40 working hours.

Overtime cannot be more than:

- per year;

- 30 hours (or 20 night hours) per month;

- 6 hours per day;

- 4 hours per night.

Overtime pay rate is:

- 150% on working days;

- 175% during holidays;

- 200% during public holidays.

Rest

Working lunchtime in Bulgaria cannot be shorter than 30 minutes, rest after work cannot be less than 12 hours, and weekly rest periods must be 2 consecutive days with a 5-day schedule, and holidays are non-working days.

The employee is not obliged to perform his work after the end of the working day or on weekends.

Vacation

Bulgarian legislation, the Labor Code, clearly states that all employees are entitled to a minimum paid annual leave of 20 days. The parties may agree on a longer vacation but in no case a shorter one.

In the event that an employee decides to quit, his unused vacation days are subject to compensation.

Before going on vacation, the employee must work for at least 8 months.

Vacation days must be used by the employee during the calendar year, in some cases, unused days can be carried over to the next year, but they must be used before the middle of next year. Compensation for unused vacation days is possible only in the event of an employee’s dismissal.

Holidays

Holidays are not included in vacation and are not taken into account.

The reward for a workflow completed on a holiday must be twice the size (minimum) of the normal one.

Sick days

The employer covers 70% of the employee’s salary in case of illness only for the first 3 days in the amount of 70%, the remaining days are covered by the National Social Security Institute after the employee provides the relevant documents.

An employee must complete the first six months of employment before being eligible for sickness benefit, unless the illness is caused by an accident at work or an occupational disease (if the employee is a minor).

Sick leave or injury compensation is either:

- 80% of the average daily gross salary, with a maximum social security base of 2600 BGN, or

- 90% of the average daily gross salary if a labor accident or professional illness occurs, with a maximum social security base of 2600 BGN.

An employee is entitled to 18 consecutive months of leave only if he is seriously ill.

Maternity leave

Maternity leave is available for up to 410 days, 45 of which must be taken during the last term of pregnancy, and covers 90% of the mother’s salary. The father is entitled to 15 days’ leave from the date of the birth of the child.

If childcare is transferred to the father when the child reaches 6 months, the father will receive the right and benefit for 410 days.

Social security and health insurance

In Bulgaria, 32.7% of the employee’s gross income is paid to social security; this percentage is shared between the employee and the employer. The maximum threshold is BGN 3,400, the minimum depends on the type of activity and profession.

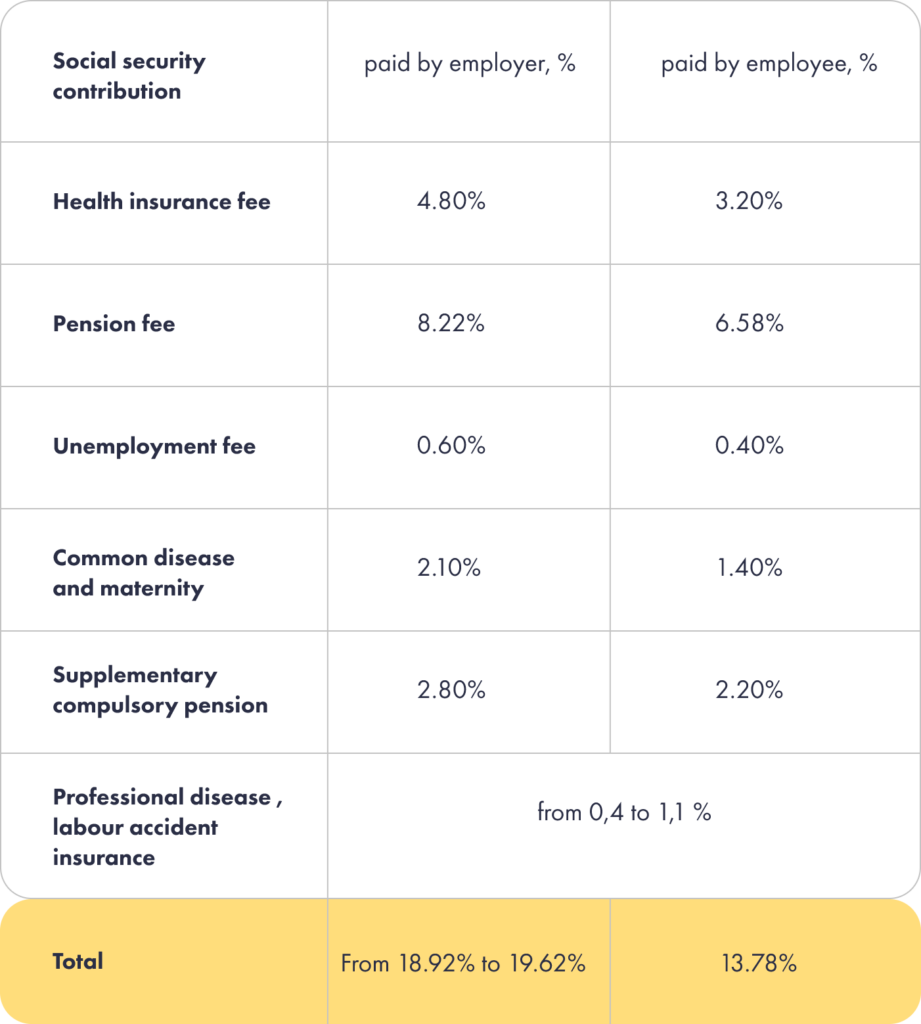

Contribution percentage:

Directors’ fees are subject to the same taxes and social contributions as under an employment contract. Foreigners may be exempt from social security contributions in Bulgaria or contributions paid in Bulgaria may be recognized in their home country in accordance with the applicable social security treaties.

Self-employed/Freelancers

Self-employed persons are fully responsible for social insurance. The maximum threshold is the same – BGN 3,400, and the minimum threshold is BGN 710, even if the income received is less. The social contribution rate is 17.80%.

Concealment of deductions in the amount of more than 3,000 leva is a criminal offense.

Posted Workers

EU Regulation 883/2004 on social security also applies to Bulgarian workers posted to another EU Member State and foreign workers posted to Bulgaria from another EU Member State. In both cases, workers can remain within their home social security law if the working period is less than 2 years.

Termination of the employment

Employment may be terminated with one or three months’ notice.

The National Revenue Agency must be notified of the termination within seven days of its entry into force via a standardized form giving details of the termination.

If the employer fails to notify the NRA within the prescribed period, a fine of up to BGN 15,000 will be imposed on the employer.